Introduction

Let’s face it — car repairs don’t come cheap these days, especially when you’re hit with unexpected damages. Imagine paying for insurance, filing a claim after an accident, and still ending up footing a large chunk of the repair bill. Sounds frustrating, right?

That’s exactly where Zero Depreciation Insurance steps in.

Whether you’ve just bought your dream car or are renewing your policy, you’ve probably heard the buzz around this popular add-on. But what is zero dep insurance? Why is everyone talking about it? And more importantly — is it really worth it?

Let’s break it down.

What Is Zero Depreciation Car Insurance?

In simple terms, Zero Dep Insurance, also known as Zero Dep cover or Bumper-to-Bumper Insurance, is an add-on to your regular comprehensive car insurance policy.

While a standard policy factors in depreciation (the wear and tear of your car parts) and reduces your claim amount, zero dep insurance covers the full cost of parts replacement without deducting depreciation.

Think of it as the “no-deductions” shield for your car!

🔍 Quick Definition:

Zero Depreciation cover ensures that you get the full claim amount without any reduction due to part depreciation during repairs.

How Zero Depreciation Works

Let’s understand this with a simple example:

Imagine you accidentally damage your bumper and headlights.

-

Standard insurance will cover the repair cost after subtracting depreciation (say 30% on plastic parts, 10% on metal).

-

Zero Dep insurance, on the other hand, pays the full cost of replacement without those deductions.

That means more savings for you, especially when the repair bill runs high.

✅ Parts Typically Covered:

-

Plastic parts

-

Rubber components

-

Fiber and nylon parts

-

Glass and metal components

-

Paintwork

⚠️ However, engine damage, regular wear and tear, and consumables may still not be covered unless you buy other add-ons.

Key Benefits of Zero Dep Insurance

So why are more car owners opting for it?

Here’s what you get:

-

🔧 Higher claim settlement: No depreciation means more money back during repairs.

-

🆕 Ideal for new cars: Keep your new car in top condition without worrying about costs.

-

💸 Minimal out-of-pocket expense: You’ll only pay the standard deductible and nothing more.

-

🔐 Peace of mind: Whether you’re a new driver or experienced one, you’re protected against rising repair costs.

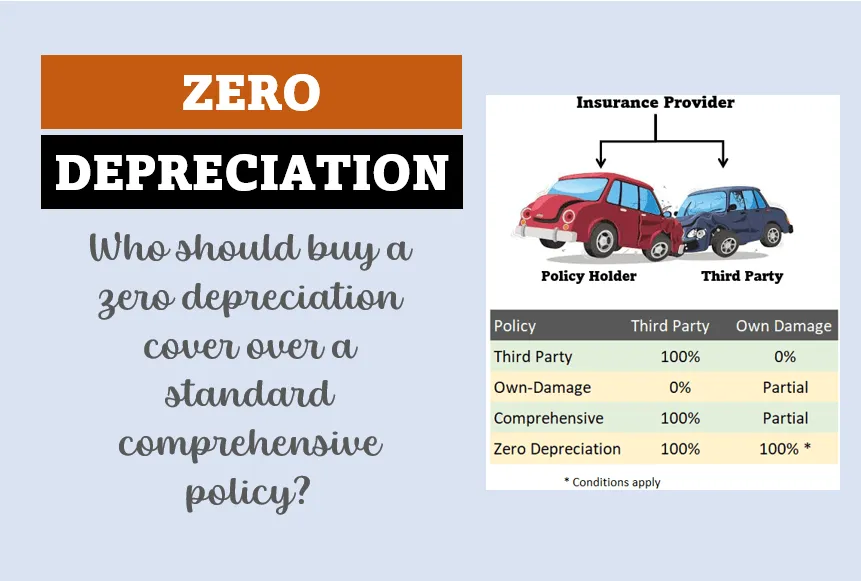

Who Should Buy Zero Dep Insurance?

Not every car owner needs it — but if you fall into any of these categories, you should seriously consider it:

-

🚗 New Car Owners (0–5 years)

Protect your investment right from day one. -

💎 Luxury or High-End Car Owners

Premium parts are expensive. Zero dep keeps the repair costs from burning your pocket. -

🏙️ Urban Drivers

City traffic = higher chances of fender-benders. Zero dep is your best friend. -

👶 First-Time Buyers

If you’re not familiar with how insurance claims work, this add-on offers stress-free coverage.

Limitations & Exclusions

Before you rush to add zero dep, here are some fine prints you must know:

-

💰 Higher Premium: It costs more than regular insurance (usually 15–25% extra).

-

🔁 Limited Claims: Some insurers limit it to 2 zero dep claims per year.

-

🧓 Vehicle Age Limit: Generally available for cars less than 5 years old.

-

⚙️ Exclusions: Doesn’t cover engine damage (unless combined with Engine Protect), mechanical failure, or routine wear & tear.

📝 Pro Tip: Always read the policy wording carefully or consult your insurer to understand the claim rules.

Top Insurers Offering Zero Dep Cover in India

Here are some popular insurance companies offering reliable zero depreciation add-ons:

| Insurance Company | Highlights of Zero Dep Cover |

|---|---|

| HDFC ERGO | Comprehensive packages with zero dep + engine cover options |

| Tata AIG | Zero dep available for cars up to 5 years; wide garage network |

| ICICI Lombard | Covers up to 2 zero dep claims per year |

| Bajaj Allianz | Add-ons can be bundled for better value |

| Digit Insurance | Easy digital claims process, transparent pricing |

🚗 Compare premium and claim process before you decide — not all zero dep covers are the same.

Is Zero Dep Insurance Worth It?

Let’s weigh the pros and cons:

✅ Pros:

-

Full claim without part deductions

-

Ideal for costly repairs

-

Better resale value for well-maintained cars

❌ Cons:

-

Higher premium

-

May not be useful for older cars

-

Limited claim count with some insurers

💡 Verdict:

If your car is new, expensive, or used frequently in city conditions — Zero Dep Insurance is absolutely worth the extra cost. It offers peace of mind, especially in today’s rising repair economy.

FAQs on Zero Depreciation Cover

Q. Can I buy zero dep insurance for a 5+ year old car?

Some insurers allow it up to 7 years with conditions. But in most cases, it’s available for cars under 5 years.

Q. Does it cover engine damage?

No. You’ll need a separate Engine Protect add-on for that.

Q. Is it available for used cars?

Yes, if the car’s age fits the insurer’s criteria. Always check eligibility before purchasing.

Q. Does it cover total loss or theft?

Zero Dep applies to repairable damage. In case of total loss or theft, IDV (Insured Declared Value) matters, not depreciation cover.

Conclusion

So, should you go for Zero Depreciation Insurance?

If you’re someone who prefers full protection with minimal surprises during claims — the answer is YES.

Sure, it comes at a slightly higher cost, but the savings during repair claims and the peace of mind it offers make it a no-brainer for many car owners in India today.

Don’t just take our word for it — compare plans, understand the benefits, and make an informed choice that suits your vehicle and budget.

💬 Have you tried zero dep insurance before? Share your experience in the comments below!

✅ Liked this article?

-

🔁 Share it with fellow car owners!

-

📬 Subscribe to The Torque Times for more auto insights & updates.

-

💡 Bookmark us for insurance tips, car comparisons, and the latest automotive news.

I also preferred zero dep insurance